Content

Normally, insurance companies will not also undertake to cover the demand risk. Such fluctuations are sometimes very violent and result in a loss to the businessman. It is very difficult to secure full coverage against adverse price changes. Business risk is that portion of the unsystematic risk caused by the prevailing environment of the business. In other words, business risk is a function of operating conditions being faced by a firm. These risks influence the operating income of a firm and consequently the dividends.

In November 2018, the debt holders Angelo Gordon and Solus Alternative Asset Management took control of the bankrupt company and created plans to revive the chain. In February 2019, a new company staffed with ex-Toys “R” Us execs, Tru Kids Brands, reported that it would relaunch the brand and opened two new stores that year. Recently, Macy’s has partnered with WHP Global, and together they are working on bringing back the Toys “R” Us brand. Discover the benefits of expanding a business and the disadvantages, including international expansion. These are important elements with which to create an appropriate governance framework for risk, which can involve seeking outside professional assistance – such as expert risk analysts – to determine risks and responses. Commercial risk can be handled by only trading with neighboring countries, trading with countries that speak the same language, or hiring consultants who are familiar with the customs of the country.

A professional code of ethics is usually focused on risk assessment and mitigation (by the professional on behalf of client, public, society or life in general). Governments are apparently only now learning to use sophisticated risk methods, most obviously to set standards for environmental regulation, e.g. “pathway analysis” as practiced by the US EPA. Scenario analysis matured during Cold War confrontations between major powers, notably the USA and USSR, but was not widespread in insurance circles until the 1970s when major oil tanker disasters forced a more comprehensive foresight. It entered finance in the 1980s when financial derivatives proliferated.

Management should come up with a plan in order to deal with any identifiable risks before they become too great. Apart from those given above, there are some other risks related to natural calamities like floods, earthquake, droughts, etc. which also affects the business at large. The Federal Deposit Insurance Corporation (FDIC) – Savings accounts, insured money market accounts, and certificates of deposit (CDs) are generally viewed as safe because they are federally insured by FDIC. This independent agency of the federal government insures your money up to $250,000 per insured bank.

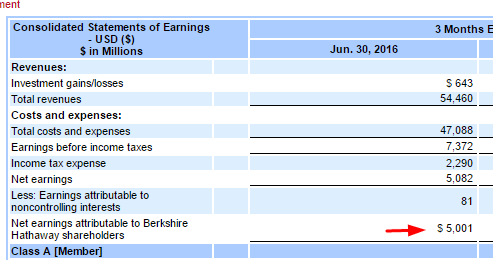

Financial risk may be due to several macroeconomic forces, fluctuating market interest rates, and the possibility of default by large organizations or sectors. When individuals run businesses, they face financial risk in making decisions that jeopardize their ability to pay debts or income. Often companies need to seek capital from outside sources for their steady growth. This funding requirement creates a financial risk for the company/ business seeking an amount and the investor/ stakeholder investing in the company’s business. The financial health of the company is the subject of financial risk. Factors that adversely impact the financial growth and profitability of a firm are called financial risk.

When a company experiences a high degree of business risk, it may impair its ability to provide investors and stakeholders with adequate returns. For example, the CEO of a company may make certain decisions that affect its profits, risk definition in business or the CEO may not accurately anticipate certain events in the future, causing the business to incur losses or fail. What’s most important is that business owners are aware of the risks that could shake up their operations.

A firm’s management team is regularly tasked with making decisions about how to grow and operate a business. However, every decision about a new product offering, a new target market, or a potential merger (and many other examples) has the potential to fail and put the company’s ability to operate at risk. This risk arises from within the corporation, especially when the day-to-day operations of a company fail to perform. For example, in 2012, the multinational bank HSBC faced a high degree of operational risk and as a result, incurred a large fine from the U.S. Department of Justice when its internal anti-money laundering operations team was unable to adequately stop money laundering in Mexico.

Effective risk management programs do not merely insure companies against downside risks, they also include proactive systems and processes to maximize the opportunities the opportunities presented by variable risks. A further demonstration of the shortcomings inherent in relying upon established measures of country risk is depicted in Fig. Each figure depicts a decade (1993–2003) of quarterly country risk measures from the International Country Risk Guide (ICRG) (). The ICRG risk measures are widely used by both practitioners and academics (e.g. La Porta, Lopez de Silanes, Shleifer, & Vishny, 1997) to capture the various dimensions of country risk and identify potential volatility.

If you have any questions regarding financial risks and types, drop them in the comment section below and we will get back to you. If you enjoy handling projects and evaluating risks, then you can become a project leader in this digital age with our Project Management Certification aligned with PMI-PMP® and IASSC-Lean Six Sigma. Attend live online interactive classes, masterclasses from UMass Amherst, Harvard Business Publishing case studies, and capstone projects. For instance, the US government issues debts that are called treasury bonds. Several governments have defaulted on debt, including Venezuela, Russia, Argentina, and Greece. Some governments only delay debt payments, while some pay less than the agreed-upon amount.

Awareness of, and familiarity with, various types of insurance policies is a necessary part of the risk management process. A final risk management tool is self retention of risks—sometimes referred to as “self insurance.” Companies that choose this option set up a special account or fund to be used in the event of a loss. Whatever the potential benefits of a strong risk management program, many organizations see plenty of challenges to implementing one. The biggest risk management challenge is as expected, will be obtaining adequate resources, namely, time, budget and people.

It is important to note that the total is per depositor not per account. But there’s a tradeoff between security and availability; your money earns a low interest rate. This means that SMEs and young firms may be more likely to pursue arbitrage/prediction, real options, and adaptation strategies, though large, established firms are not necessarily precluded from pursuing these strategies as well. An overview of the eight strategies, their objectives, and their scope is presented in Figure.

Businesses have several alternatives for the management of risk, including avoiding, assuming, reducing, or transferring the risks. Avoiding risks, or loss prevention, involves taking steps to prevent a loss from occurring, via such methods as employee safety training. As another example, a pharmaceutical company may decide not to market a drug because of the potential liability.

New risks will be introduced through the development of new products, the introduction of new technology, and changes attributable to merger and acquisition activity. When leadership does not embrace a culture of risk management, risk improvement initiatives can be doomed from the outset. In case of a financial risk, there is a possibility that a company’s cash flow might prove insufficient to satisfy its obligations. Some common financial risks are credit, operational, foreign investment, legal, equity, and liquidity risks. Operational risk is a type of risk that exists within a company’s system or processes or even people.

Many risks exist in a business, but they can be mitigated by taking certain precautions. Management may use strategies to reduce the chances of certain occurrences happening, resulting in a loss. Nationwide student-led protests may not affect the investment and business climate at all.

Financial risk may include excess debt, mismanagement of cash flow, and change in how bad debt reserves are estimated. Financial risks may also arise due to fluctuation in market interest rates and exchange rate. Making a sound business case for having a strong risk management program has long been an elusive challenge for many organizations. The question still remains unanswered, “How much value should be placed on preventing loss from a disaster that might never happen?

Uncertainty can also result in business failure and even bankruptcy. However, companies implement differentiation strategies and try to change consumers’ perceptions that their products are better. A risk, in a business context, is anything that threatens an organization’s ability to generate profits at its target levels; in the long term, risks can threaten an organization’s sustainability. The importance of risk management in projects can hardly be overstated. Awareness of risk has increased as we currently live in a less stable economic and political environment. Effective risk management programs do not rely on the work and resources of any single person or group within the organization.

A familiar financial aspect of this type of risk comes in the form of tariffs. It is usually a percentage of the value of the product being imported. Another risk is a quota, which is a limit on the number of goods a particular country is allowed to export to another. Either situation can drive up the cost of goods which leads to an amount of risk. Companies may face compliance risk if they are required to follow new rules established by the government or a regulatory body.

Companies need to make sure they develop risk management programs that work. Besides addressing both variable and downside risks on an enterprise wide basis, programs are needed that should incorporate systems and processes for preventing, not just insuring against common risk factors. Insuring against the downside impact of risk factors should be a company’s last and not first line of defence.

Nenhum comentário